Refinance Mortgage Services

Refinance mortgage loan services in NZ designed to reduce repayments, improve rates and simplify your lending. Get expert advice & start your refinancing today.

Mortgage Refinance Services in New Zealand

Refinancing your home loan can be one of the smartest financial decisions you make. Whether your goal is to reduce interest costs, consolidate debt, unlock equity, or restructure your repayments, mortgage refinance services help ensure your loan continues to work for you.

At Loans and Mortgages, we provide tailored mortgage refinance solutions in NZ, helping homeowners and investors secure better loan structures aligned with their current and future financial goals.

What Is Mortgage Refinancing?

Mortgage refinancing involves replacing your existing home loan with a new one, either with the same lender or a different lender, under improved terms. This may include a lower interest rate, better repayment structure, or additional borrowing.

Refinancing is commonly used to:

Reduce interest rates and repayments

Consolidate high-interest debts

Access home equity for investment or renovations

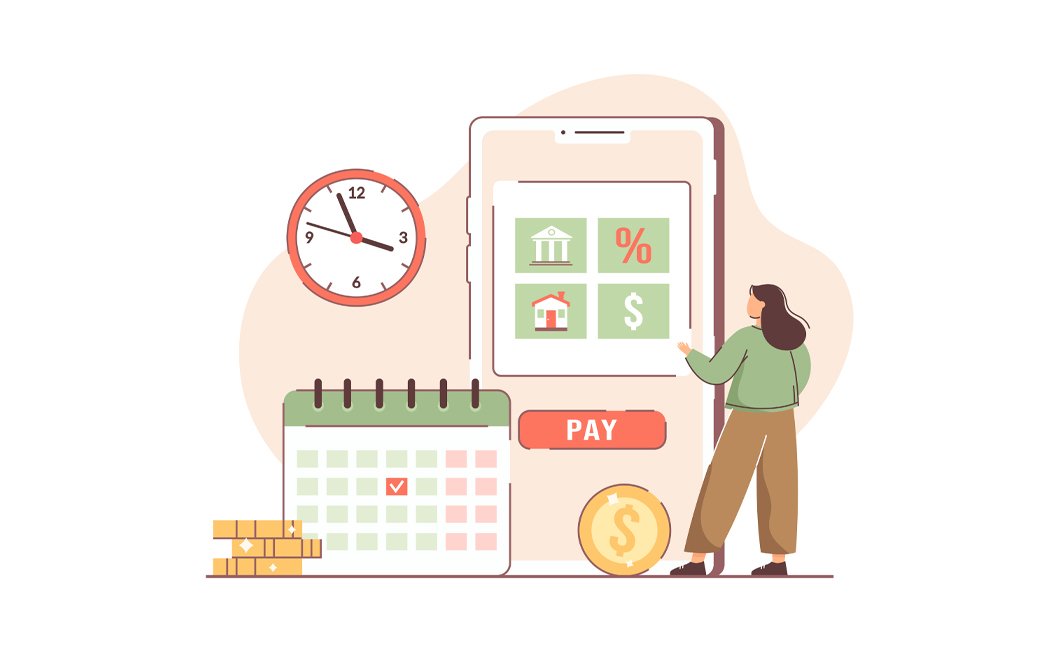

Switch loan types or restructure mortgages

Improve cash flow and financial flexibility

How Mortgage Refinance Works in New Zealand

With Loans and Mortgages, we access:

Your current loan balance and property value

Equity available in your property

Access home equity for investment or renovations

Credit history and repayment behaviour

Depending on your situation, refinancing may involve:

Changing lenders for better rates or features

Restructuring loans with your current lender

Splitting loans into fixed and floating portions

Our advisers manage the entire process, from lender comparison to settlement, ensuring a smooth and stress-free refinance.

Benefits of Refinancing Your Mortgage

Lower interest rates and reduced repayments

Improved loan features and flexibility

Consolidation of personal or business debt

Access to equity for investment or upgrades

Loan structures aligned with life or income changes

Refinancing isn’t just about chasing a lower rate, it’s about building a smarter mortgage strategy.

When Should You Consider Mortgage Refinance?

Mortgage refinance services are ideal if:

Your fixed rate is ending soon

Interest rates have dropped since your last loan

Your income or financial situation has changed

You want to invest, renovate, or consolidate debt

Your current loan structure no longer suits your goals

Even small changes can deliver long-term financial benefits when structured correctly.

Why Choose Loans and Mortgages for Mortgage Refinance?

- Access to multiple NZ lenders, not just one bank

- Strategic loan structuring beyond basic refinancing

- Advice tailored to homeowners and property investors

- Transparent guidance with no pressure

- End-to-end support from review to settlement

We focus on long-term outcomes, not quick approvals.

Our Other Loan & Mortgage Services

First Home Buyer Loans

Support for first-time buyers navigating deposits, approvals, and competitive home loan options.

Commercial Investment Property Loans

Specialised lending for offices, retail, industrial, and mixed-use investment properties.

Investment Property Loans

Flexible mortgage solutions designed for both residential and commercial property investors.

Refix Mortgage Services

Expert guidance to secure competitive rates when your fixed term ends.

Mortgage Refinance Services

Restructure or switch lenders to reduce interest costs or consolidate debt.

Mortgage Restructure

Optimise your current mortgage setup to better suit changing financial circumstances.

Home Renovation Loans

Funding solutions for upgrades, extensions, and home improvements using smart lending strategies.

Equity Release Services

Unlock the value in your property to invest, renovate, or consolidate debt.

Residential Investment Property Loans

Tailored finance solutions for building and growing residential property investment portfolios.

Mortgage Refinance FAQs

Refinancing can be worthwhile if the savings or benefits outweigh the costs. A proper loan review helps determine the true value.

Yes. Many homeowners refinance to access equity for renovations, investments, or debt consolidation.

Not always. Refinancing can be done with your current lender or by switching to a new one for better terms.

There may be legal, valuation, or break fees, depending on your loan. We assess these upfront before proceeding.

Pre-approval usually takes 1–5 working days depending on lender response and documentation.

Speak to a Mortgage Refinance Specialist

If your current home loan no longer suits your needs, refinancing could unlock better financial outcomes. Talk to Loans and Mortgages today to explore personalised mortgage refinance services in NZ and take control of your home loan with confidence.