Equity Release Services NZ

Access equity release services in NZ with expert guidance, secure lending options & simple processes to unlock funds. Start your application today.

Equity Release Loans in New Zealand

An equity release loan allows you to unlock the value in your property and use it for investments, renovations, debt consolidation, or other financial goals — without selling your home. If your property has increased in value over time, equity release can be a powerful way to put that wealth to work.

At Loans and Mortgages, we provide tailored equity release solutions in New Zealand, structured to suit your long-term plans while keeping repayments manageable.

What Is Equity Release?

Equity release involves borrowing against the portion of your property that you already own. The funds released can be used for a wide range of purposes, while you continue to own and live in your property.

Equity is calculated as:

Property Value – Existing Mortgage = Available Equity

Our advisers assess your equity position and structure loans that align with your financial objectives.

How Equity Release Works in New Zealand

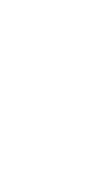

Equity release loans are typically set up as:

A top-up on your existing mortgage

A separate loan facility (fixed or floating)

A revolving credit or redraw facility

Lenders consider:

Property value and location

Existing mortgage balance

Income and affordability

Overall financial position

We work with multiple NZ lenders to structure equity release loans responsibly and strategically.

Common Uses for Equity Release Loans

Mortgage Top-Up

Add funds to your existing loan with minimal changes to your current setup (subject to lender approval).

Refinance for Equity Release

Restructure your mortgage to unlock equity, often used when you want better rates, improved cash flow, or a new loan split strategy.

Split Loan Structure

Separate your equity release amount into its own portion (fixed or floating) so you can manage repayment strategy and interest costs more effectively.

Benefits of Equity Release

Access funds without selling your home

Use equity strategically to build wealth or improve lifestyle

Flexible repayment options depending on loan structure

Potentially lower interest rates compared to unsecured lending

Ability to consolidate debt into one manageable repayment

Equity Release Can Be Used For

Purchasing an Investment Property

Use your home equity as funding support to enter or expand property investment—often as a deposit or to strengthen your lending position.

Home Renovations or Extensions

Fund value-adding improvements without needing a separate personal loan, with a structure aligned to your existing mortgage.

Debt Consolidation

Combine higher-interest debts into a single home-loan repayment to simplify finances and potentially reduce interest costs.

Funding Business or Personal Investments

Access capital for approved investment purposes where affordability and risk are considered carefully.

Assisting Family Members With Property Purchases

Support family with a deposit or bridging finance while maintaining a clear repayment strategy and long-term plan.

Our advisers help you choose the most suitable renovation finance option based on your property and long-term plans.

Is Equity Release Right for You?

- Homeowners with strong equity and stable income

- Investors planning to grow a property portfolio

- Families supporting first-home deposits

- Homeowners wanting to renovate rather than move

- Borrowers consolidating debt for better cash flow

If you’re unsure, Loans and Mortgages can assess your numbers and recommend the most suitable structure.

Our Other Loan & Mortgage Services

First Home Buyer Loans

Support for first-time buyers navigating deposits, approvals, and competitive home loan options.

Commercial Investment Property Loans

Specialised lending for offices, retail, industrial, and mixed-use investment properties.

Investment Property Loans

Flexible mortgage solutions designed for both residential and commercial property investors.

Refix Mortgage Services

Expert guidance to secure competitive rates when your fixed term ends.

Mortgage Refinance Services

Restructure or switch lenders to reduce interest costs or consolidate debt.

Mortgage Restructure

Optimise your current mortgage setup to better suit changing financial circumstances.

Home Renovation Loans

Funding solutions for upgrades, extensions, and home improvements using smart lending strategies.

Equity Release Services

Unlock the value in your property to invest, renovate, or consolidate debt.

Residential Investment Property Loans

Tailored finance solutions for building and growing residential property investment portfolios.

Equity Release FAQs

It depends on your property value, existing mortgage, lender policies, and affordability. A quick assessment can estimate what’s realistically available.

It can. Your repayments depend on the amount borrowed, interest rate, and loan structure. Splitting loans can help control repayments.

Often yes, subject to lender approval and your affordability. The right structure can improve your investment lending strategy.

Not always. Equity release can be done via a top-up or by refinancing. Refinancing is commonly used when you want to restructure or improve your overall lending position.

Talk to an Adviser About Equity Release

If you want to unlock your home’s value and put your equity to work, Loans and Mortgages can help you choose the safest and most effective option.