Mortgage Loan Restructure Services NZ

Access mortgage loan restructure services in NZ to lower repayments, improve terms and optimise your lending. Get expert support and explore your options today.

A mortgage that once suited your situation may no longer align with your income, lifestyle, or long-term goals. Changes in interest rates, family circumstances, or financial priorities often require a smarter loan setup.

At Loans and Mortgages, our mortgage restructure services help homeowners and investors reorganise their existing loans for better cash flow, flexibility, and long-term financial stability.

What Is a Mortgage Restructure?

A mortgage restructure involves reorganising your current home loan without necessarily changing lenders. This may include:

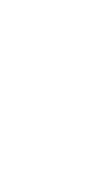

Splitting loans into fixed and floating portions

Consolidate high-interest debts

Switching between interest-only and principal & interest

Consolidating multiple loans into a clearer structure

The goal is to ensure your mortgage works with your financial situation, not against it.

How Mortgage Restructuring Works in New Zealand

Mortgage restructuring focuses on improving affordability and flexibility while keeping your lending aligned with lender policies in NZ. The process includes:

Reviewing your existing loan structure

Assessing interest rates and repayment types

Evaluating cash flow, income, and future plans

Reorganizing loans to reduce financial pressure

Our advisers work with your current lender or explore alternatives if restructuring alone isn’t sufficient.

How Mortgage Restructuring Works in New Zealand

1. Improving Cash Flow

Adjusting loan terms or switching to interest-only repayments can reduce monthly commitments.

2. Managing Interest Rate Risk

Adjusting loan terms or switching to interest-only repayments can reduce monthly commitments.

3. Life & Financial Changes

Marriage, children, business changes, or income adjustments often require a new loan strategy.

4. Simplifying Multiple Loans

Combining loans into a cleaner structure improves visibility and long-term planning.

Benefits of Mortgage Restructure Services

A well-structured mortgage can significantly improve your financial confidence.

Lower monthly repayments

Better alignment with financial goals

Improved loan flexibility

Reduced stress during interest rate changes

More control over debt management

Who Should Consider Mortgage Restructuring?

Mortgage restructure services are suitable for:

Homeowners feeling pressure from repayments

Property investors managing multiple loans

Borrowers nearing refix or loan expiry

Families experiencing income or lifestyle changes

Anyone unsure if their current mortgage is still optimal

If your mortgage hasn’t been reviewed recently, restructuring may deliver immediate benefits.

Why Choose Loans and Mortgages?

- Access to multiple NZ lenders

- Personalised loan analysis and structuring

- Honest, transparent advice

- Experience across residential and investment lending

- Ongoing support beyond settlement

We focus on sustainable mortgage solutions — not short-term fixes.

Our Other Loan & Mortgage Services

First Home Buyer Loans

Support for first-time buyers navigating deposits, approvals, and competitive home loan options.

Commercial Investment Property Loans

Specialised lending for offices, retail, industrial, and mixed-use investment properties.

Investment Property Loans

Flexible mortgage solutions designed for both residential and commercial property investors.

Refix Mortgage Services

Expert guidance to secure competitive rates when your fixed term ends.

Mortgage Refinance Services

Restructure or switch lenders to reduce interest costs or consolidate debt.

Mortgage Restructure

Optimise your current mortgage setup to better suit changing financial circumstances.

Home Renovation Loans

Funding solutions for upgrades, extensions, and home improvements using smart lending strategies.

Equity Release Services

Unlock the value in your property to invest, renovate, or consolidate debt.

Residential Investment Property Loans

Tailored finance solutions for building and growing residential property investment portfolios.

Mortgage Restructure FAQs

No. Mortgage restructuring reorganises your existing loan, while refinancing usually involves switching lenders.

Yes, though break fees may apply. We assess costs before recommending any changes.

It can. Rates depend on the new structure and loan type selected.

Yes. Mortgage restructuring is commonly used by residential and commercial property investors.

Speak to a Mortgage Restructure Specialist

If your mortgage no longer suits your needs, it may be time for a smarter structure. Contact Loans and Mortgages today to review your loan setup and explore tailored mortgage restructure solutions that support your financial future.